reit dividend tax philippines

A the dividends are received by a nonresident alien individual or. Of this 120 of the dividend comes from earnings.

Reit Investment In The Philippines The Facts You Need To Know Blog Citiglobal

It debuted in the Philippine Stock Exchange on March 23 2021 with.

. Since REITs are obliged by law to maintain 33 of the companys share to be owned by public investors and distribute a minimum of 90 of their taxable income to. The REIT generates 2 per unit from operations and distributes 90 or 180 to unitholders. Dividends Paid by REITs.

DDMP REIT Inc. In the Philippines the main barrier to investing in real estate is the high price high taxes and difficulty of liquidating. More so for OFWs who invest in Philippine REITs as theyre exempted from paying the 10 income tax or withholding tax on dividends for seven years starting from January 20.

A REIT solves these problems by subdividing the property. Founded by Edgar Sia II. The tax exemption for overseas Filipinos who receive dividends from REITs was contained in the REIT Act of 2009.

So to summarize the tax to be withheld on cash dividend income received by these individuals is as follows. The tax regulations were issued during the term of Revenue. - Cash or property dividends paid by a REIT shall be subject to a final tax of ten percent 10 unless.

A 25 rate if they are foreign citizens doing business in the Philippines if no double tax treaty applies. Foreign companies are subject to a 15 or 30 dividend tax rate. They also offer tax advantages for overseas Filipino investors as they dont need to pay dividend taxes for 7 years once REIT tax regulations are in place.

The Real Estate Investment Trust REIT Act of 2009 proposes several incentives for establishing these corporations in the country including tax exemptions on revenues and. Cash dividends received by these individuals are taxed at 25. Amount of Cash Dividend Per Share.

The remaining 060 comes. The main difference between a REIT and a non-REIT publicly. REITs in the Philippines.

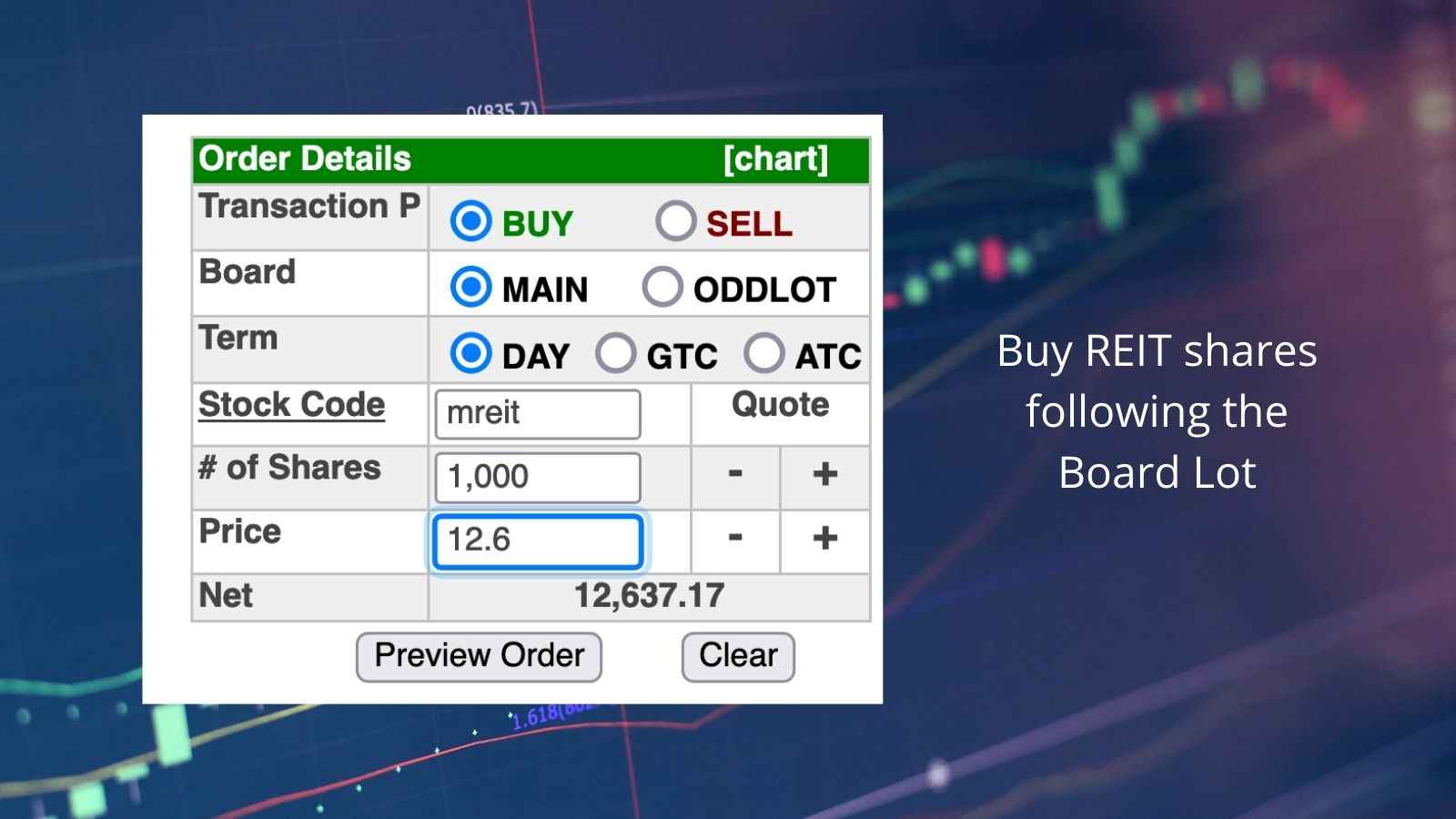

DDMPR The real estate investment trust of Double Dragon Inc. The Real Estate Investment Trust REIT Act of 2009 proposes several incentives for establishing these corporations in the country including tax exemptions on revenues and shareholder. The shares of a REIT company can be bought through any of the local stock brokers and traded in the Philippine Stock Exchange.

Gsis Sss Dividend Gains On Areit Ddmp Reit

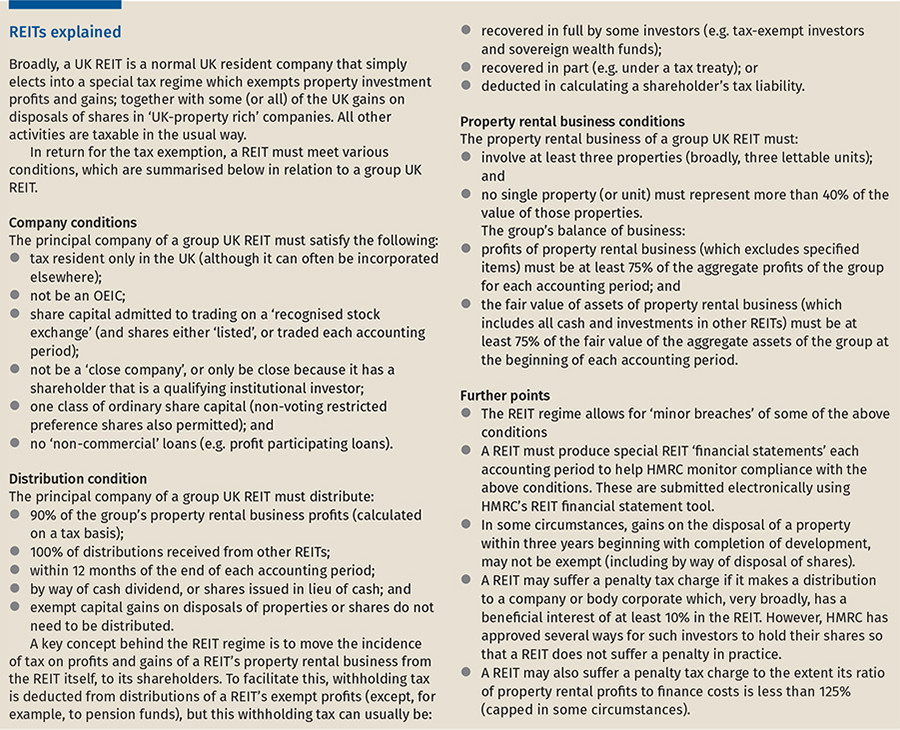

Taxation Of Reits Ringing In The Changes

How To Invest In Reits In The Philippines In 2022

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

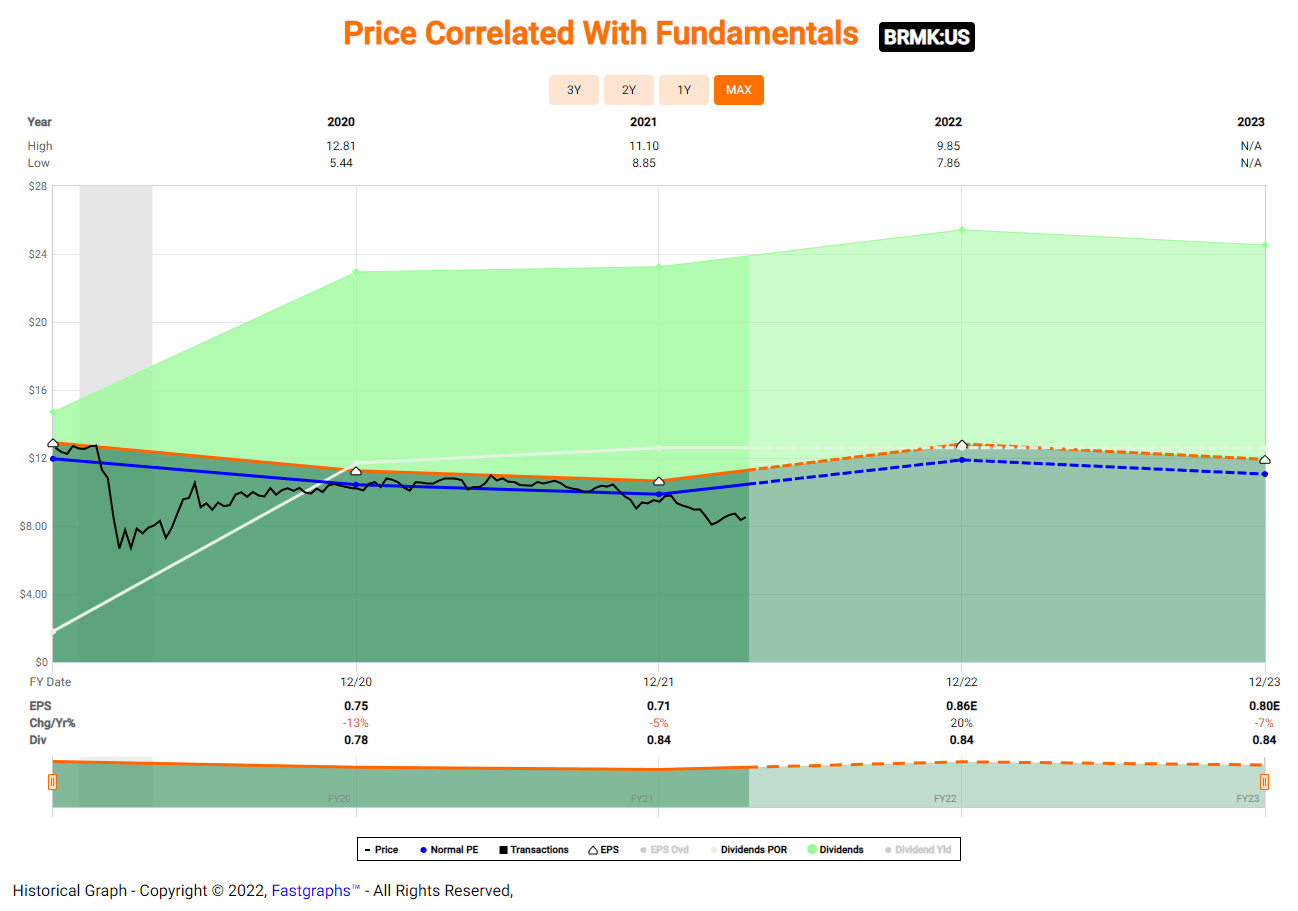

Why Don T More Reits Pay Monthly Dividends Seeking Alpha

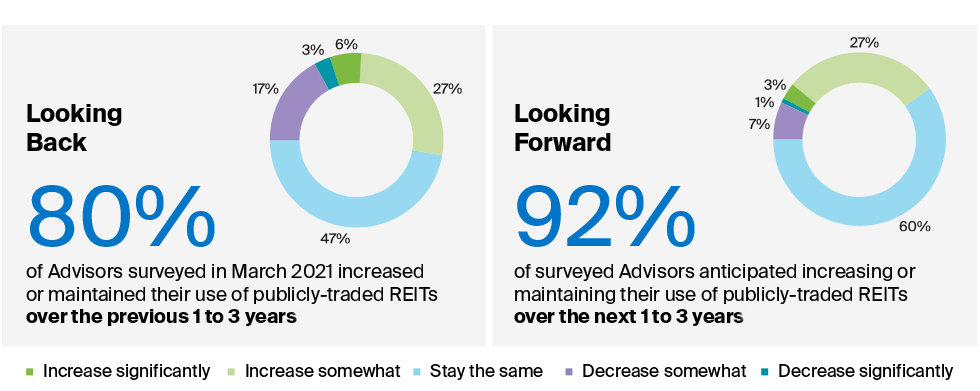

Why Invest In Reits Benefits Of Reit Investing Nareit

Emergence Of Real Estate Investment Trust Reit In The Middle East

Why Don T More Reits Pay Monthly Dividends Seeking Alpha

Solved Final Tax Rates Write The Final Tax Rate Applicable For Each Income If It Is Exempt Write Ex If It Is Subject To Other Income Tax Schemes Course Hero

How Reit Regimes Are Doing In 2018 Ey Global

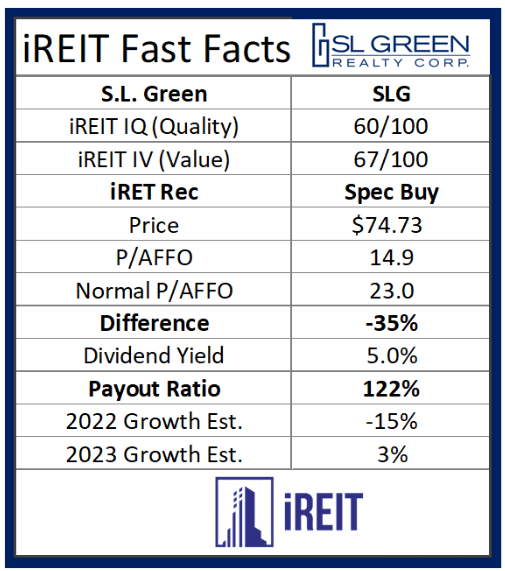

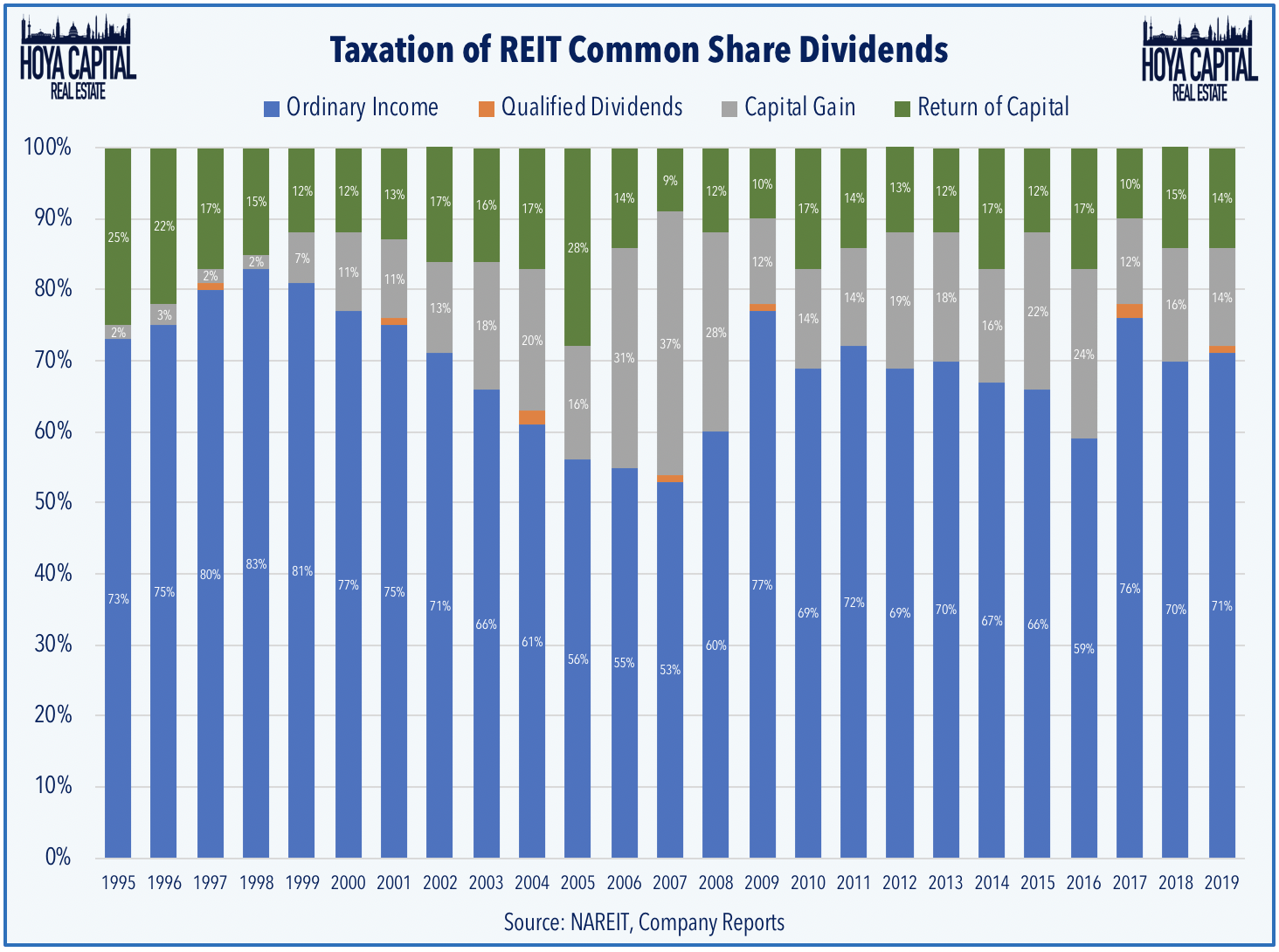

The Taxman Cometh Reits And Taxes

Philippines Tax Talk Understanding The Reit Act Incorp Philippines

Implementing Rules And Regulations Of The Real Estate Investment Trust Reit Act Of 2009 Reit Philippines

The Taxman Cometh Reit Tax Myths Seeking Alpha

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof Nasdaq

A Short Lesson On Reit Taxation

Upcoming Reit Dividends This September 2021 Reit Philippines

Real Estate Investment Trusts Reits The Next Big Thing In Real Estate Foreclosurephilippines Com