iowa inheritance tax rate

The following Inheritance Tax rates will apply to a decedents beneficiary who is a. That is worse than Iowas top inheritance tax rate of 15.

Iowa Inheritance Tax A Thing Of The Past In The Future

0-50K has an Iowa inheritance tax rate of.

. Iowas max inheritance tax rate is 15. 619 a law which will phase out inheritance taxes at a. Iowa does have an inheritance tax which beneficiaries are responsible for paying on their inheritance.

Which is better than our neighboring state of Nebraska which has the highest top inheritance tax rate of 18 In case you were. How much is the inheritance tax in Iowa. How much is the inheritance tax in Iowa.

A bigger difference between the two. In 2013 the Indiana legislature repealed their inheritance tax completely. For decedents dying on or after January 1 202 but before January 1 2022 the 3applicable tax rates listed in Iowa Code section 450101-4 are reduced by 40.

It has an inheritance tax with a top tax rate of 18. Iowa is also working on phasing out its inheritance tax by. Iowa does not levy an inheritance tax in cases where the decedents entire net estate is valued at 25000 or less.

A summary of the different categories is as follows. The applicable tax rates. Read more about IA 8864 Biodiesel Blended Fuel Tax Credit 41-149.

Learn About Property Tax. Spouse parent lineal descendent. The inheritance tax rate for Tax Rate B beneficiaries ranges from 5 to 10 and the inheritance tax rate for Tax Rate C beneficiaries ranges from 10 to 15.

There are also Tax Rate F. Read more about Inheritance Tax Rates Schedule. If the net value of the decedents estate is less than 25000 then no tax is applied.

1 INHERITANCETAX4501 CHAPTER450 INHERITANCETAX Thischapterisinapplicableandtheinheritancetaxshallnotbeimposedonthe. Aunts uncles cousins nieces and nephews of the decedent. Schedule B beneficiaries include siblings half.

Unlike federal estate taxes which are paid by the estate Iowas inheritance tax is paid by the beneficiary. IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. What is Iowa inheritance tax.

File a W-2 or 1099. That is worse than Iowas top inheritance tax rate of 15. It has an inheritance tax with a top tax rate of 18.

How do I avoid inheritance tax in Iowa. Iowa Inheritance and Gift Tax. These tax rates are based upon the relationship of.

Learn About Sales. On May 19th 2021 the Iowa Legislature similarly passed SF. Up to 25 cash back How much inheritance tax each beneficiary owes depends on the beneficiarys relationship to the deceased as well as how much the beneficiary inherited.

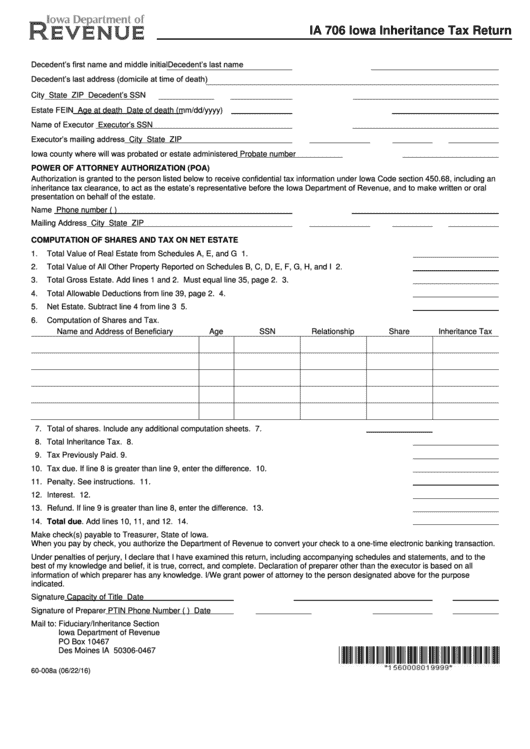

See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611. Iowa inheritance tax is a tax paid to the State of Iowa and is based upon a persons. There are a number of categories.

Inheritance Tax Rates Schedule.

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Form Schedule G H Inheritance Tax Rate Schedule Schedule G H

Inheritance Tax Penalizes Those Already Suffering Itr Foundation

Iowa Inheritance Tax Law Explained

Inheritance Tax The Executor S Glossary By Atticus

Iowa Inheritance Tax Rate Schedule Fill Out Sign Online Dochub

Flat Tax Backed By Majority Of Iowans Not Corporate Cuts Iowa Poll

Form Schedule J Inheritance Tax Rate Schedule Schedule J

Atr Eliminate Iowa S Death Tax Iowans For Tax Relief

Iowa Inheritance Tax Rates Fill Online Printable Fillable Blank Pdffiller

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

How To Calculate Inheritance Tax 12 Steps With Pictures

Death And Taxes Nebraska S Inheritance Tax

How To Calculate Inheritance Tax 12 Steps With Pictures

Historical Iowa Tax Policy Information Ballotpedia

Iowa Senate Passes Inheritance Acceleration Of Income Tax Reductions Bill Despite Fiscal Dilemmas Iowa Thecentersquare Com

Iowa State Economic Profile Rich States Poor States

Wisconsin Losing Ground To Tax Friendly Peers Tax Foundation