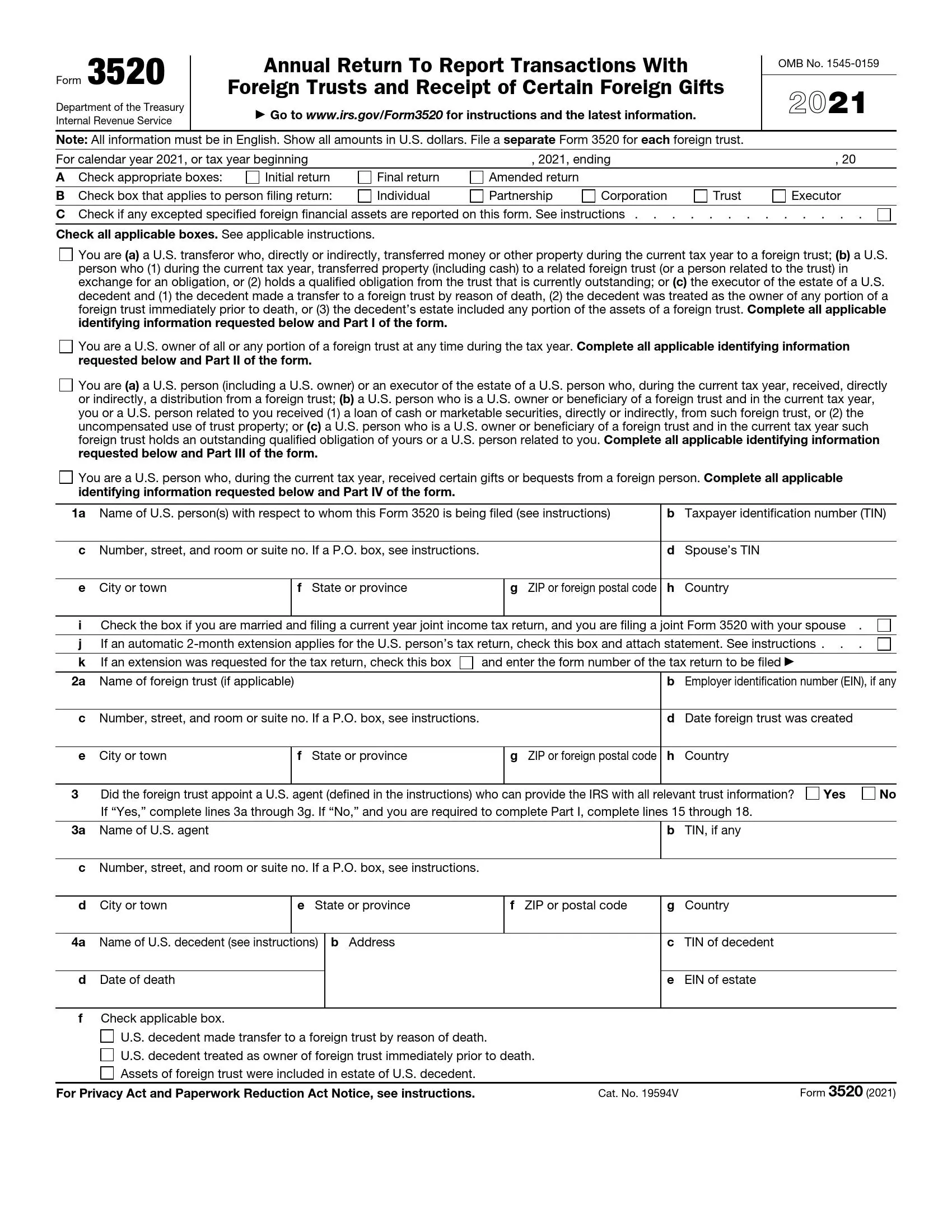

foreign gift tax return

Gift tax return and pay any gift tax owing. Citizen gives 100 acres he owns in Mexico to someone whether or not the recipient is a US.

Gifting Money To Family Members Everything You Need To Know

On a gift tax return you report the fair market value of the gift on.

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

. Citizen it is subject to the gift tax rules if the land is worth more than annual gift exclusion amount. 5 per month up to a maximum penalty of 25 of the 100000 amount of unreported foreign gifts andor unreported foreign inheritances also called foreign bequests for failure to report the gift or inheritancebequest on Form 3520 Part IV. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

Data are compiled from Form 709. The gift tax return is due on April 15th following the year in which the gift is made. This study includes information on gifts to individuals and charities that exceed the annual exclusion.

For example if a US. For other forms in the Form 706 series and for Forms 8892 and 8855 see the related instructions for due date information. Property can access the annual exclusions of US15000 and US155000 but not the lifetime exemption for gift tax purposes Canadians who make gifts of US.

For Foreign Gift or Foreign Inheritance Issues. A gift of foreign real estate from a US. Gift tax exposure for snowbirds and other Canadians.

Data are collected for the donor of the gift the amount of each individual gift reported the computation of lifetime gifts and calculation of tax liability. A foreign country or a US. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts.

Because Canadians gifting US. Gift Tax Gift Tax OneSheet PDF. Department of Treasury Internal Revenue Service Center Ogden UT 84201.

Property above these thresholds must file a US.

Irs Form 3520 Fill Out Printable Pdf Forms Online

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

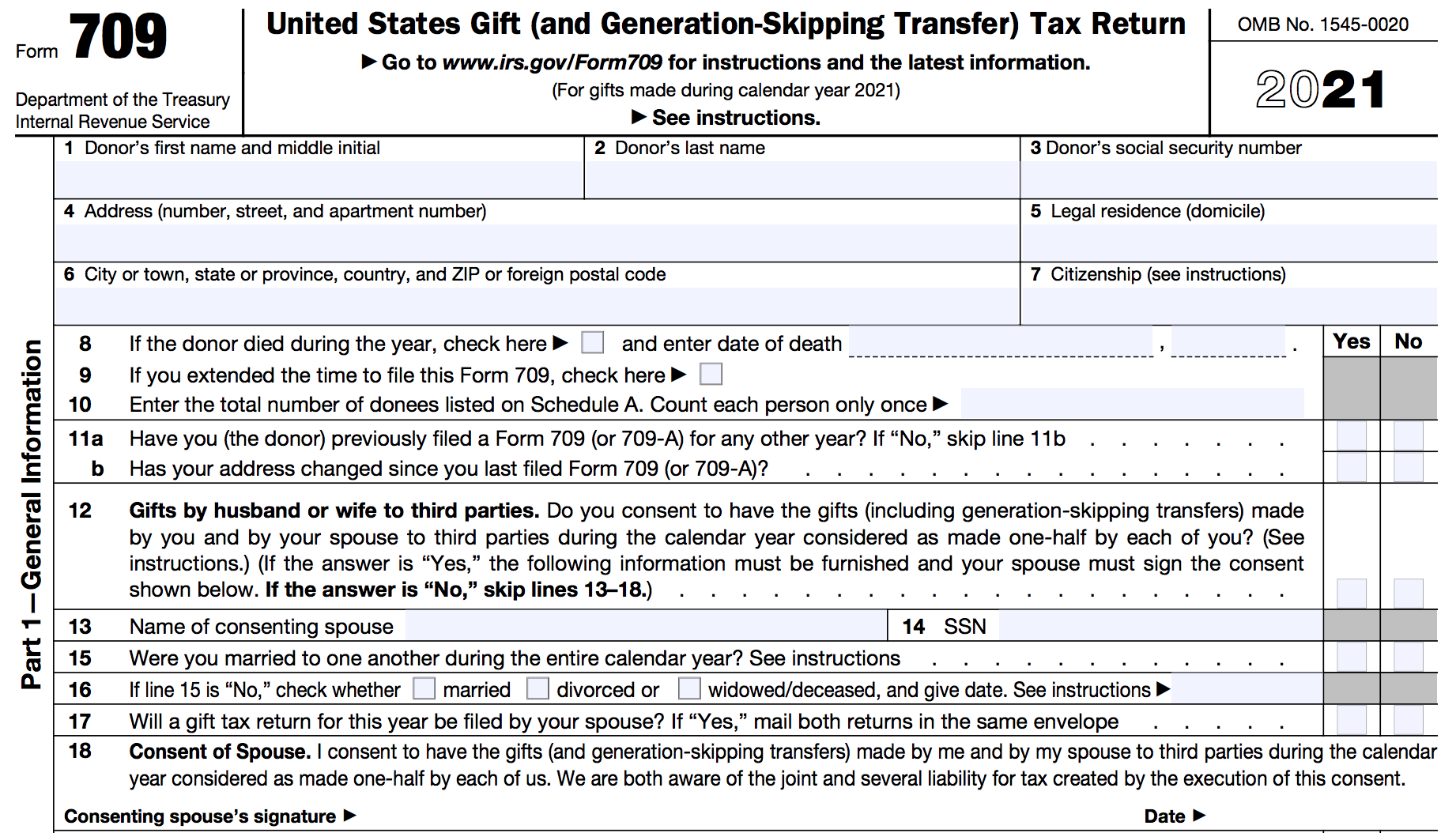

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Gifts From Foreign Persons New Irs Requirements 2022

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

Foreign Gifts When Do You Have To Report Them Freeman Law

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

.jpg)

Us Taxation How To Report Inheritance Received On Your Tax Returns

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

What Are The Tax Consequences Of Giving A Gift To A Foreign Person Epgd Business Law

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

How To Fill Out A Fafsa Without A Tax Return H R Block

U S Gift Taxation Of Nonresident Aliens Kerkering Barberio Co Certified Public Accountants Sarasota Fl

Gifts From Foreign Persons New Irs Requirements 2022

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

How The Us Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset